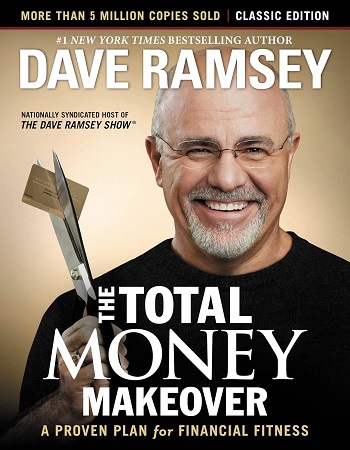

The Total Money Makeover by Dave Ramsey: A Proven 7-Step Plan to Financial Freedom

Table of Contents

Introduction

“The Total Money Makeover” by Dave Ramsey is a personal finance book that provides a step-by-step plan for getting out of debt, building wealth, and achieving financial peace. Ramsey’s approach is practical, actionable, and firmly rooted in common-sense principles. He believes in living debt-free, saving for the future, and taking control of your financial destiny. The book is a guide for individuals and families who want to transform their financial lives.

This book is written in an engaging and easy-to-understand style, with real-life examples and stories that motivate readers to take action and change their lives for the better.

The Total Money Makeover is divided into seven baby steps:

- Save $1,000 for an emergency fund.

- Pay off all debt (except for your home mortgage) using the debt snowball method.

- Save 3-6 months of living expenses in an emergency fund.

- Invest 15% of your income for retirement.

- Fund your children’s college education.

- Pay off your home mortgage early.

- Build wealth and give to others.

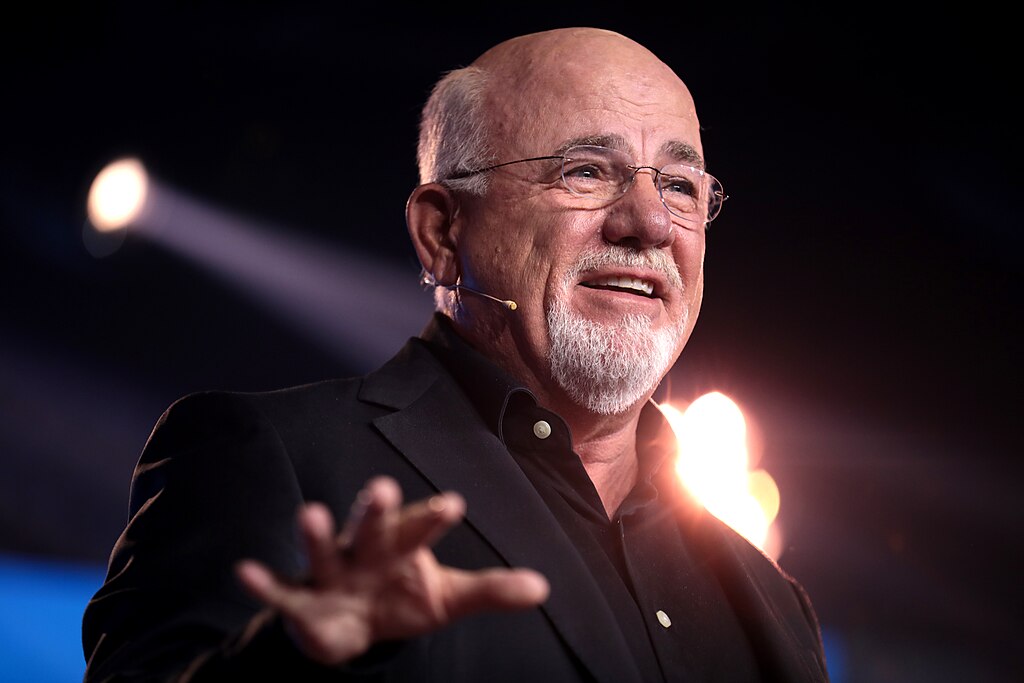

About the Author, Dave Ramsey

Gage Skidmore from Surprise, AZ, United States of America, CC BY-SA 2.0 https://creativecommons.org/licenses/by-sa/2.0, via Wikimedia Commons

Dave Ramsey is an American personal finance expert and radio personality. He is the author of several best-selling books, including The Total Money Makeover, and the host of The Dave Ramsey Show, a nationally syndicated radio program that reaches over 13 million listeners each week. Ramsey’s financial advice is based on the principles of living below your means, paying off debt, and saving for the future. He advocates a seven-step plan for financial freedom, which he calls the “Baby Steps.”

Chapter Wise Summary of “The Total Money Makeover”

Chapter 1: Super Saving In this chapter, Ramsey emphasizes the critical first step to financial success: saving. He suggests starting by saving at least $1,000 as an initial emergency fund. This fund is crucial to provide a safety net for unexpected expenses and to prevent individuals from resorting to credit cards or loans when emergencies arise.

Chapter 2: The Total Money Makeover Ramsey introduces his signature framework, the seven “Baby Steps,” which form the heart of his financial plan. These steps offer a clear and structured roadmap to financial success. The first step involves building the $1,000 emergency fund. The subsequent steps guide readers to pay off all non-mortgage debt, build a fully funded emergency fund, and invest in retirement and children’s education funds. Ultimately, the plan leads to debt freedom and long-term wealth building.

Chapter 3: Cash is King Ramsey is a strong advocate of using cash for everyday expenses. He introduces the envelope system, a practical budgeting tool. The envelope system entails allocating cash to various budget categories, such as groceries, entertainment, and dining out. This method helps individuals stick to their budgets and avoid overspending, as once the cash in a specific envelope is gone, there’s no more spending in that category for the month.

Chapter 4: Relating with Money This chapter addresses the significance of open and honest communication with your spouse about finances. Ramsey provides practical tips for managing money as a team. He underscores the importance of setting financial goals together and being accountable to each other for staying on budget and achieving those goals.

Chapter 5: Working with Money Ramsey encourages readers to work hard and increase their income. He believes that increasing one’s income is a vital component of the total money makeover. By working diligently in one’s career and seeking opportunities for additional income, individuals can accelerate the debt payoff process and save more for their financial goals.

Chapter 6: The Total Money Makeover Challenge This chapter issues a challenge to readers: put the principles discussed into action. Ramsey encourages readers to create a written budget, get their finances in order, and begin their journey toward financial transformation. He stresses the importance of taking immediate and concrete steps toward a better financial future.

Chapter 7: The Great Misunderstanding Ramsey debunks common myths about debt. He discusses how many people misunderstand debt, thinking it’s a normal and necessary part of life. However, he argues that debt is a financial burden and a significant obstacle to financial peace. Ramsey provides a compelling case for the importance of getting rid of debt.

Chapter 8: Money Myths In this chapter, Ramsey addresses and debunks common misconceptions about money. He provides insights into how to approach financial decisions, highlighting the importance of making informed choices about spending, saving, and investing.

Chapter 9: Two More Hurdles Ramsey delves into the emotional and psychological hurdles that individuals often face on their journey to financial freedom. These hurdles include fear, pride, and past financial mistakes. The author offers guidance on how to overcome these obstacles to achieve financial success.

Chapter 10: Of Mice and Mutual Funds This chapter introduces the concept of investing and explains how mutual funds can play a role in building wealth. Ramsey advocates for long-term, diversified investments in mutual funds, emphasizing the benefits of compound interest and a well-structured investment portfolio.

Chapter 11: Paying Cash for Your Cars Ramsey advocates for the practice of buying cars with cash rather than taking out loans. He suggests that individuals save up and pay for vehicles upfront, avoiding car payments and the interest that comes with them. This approach leads to financial freedom and reduces the financial burden of car ownership.

Chapter 12: A Buyer and His Adviser This chapter offers practical advice on finding a real estate agent and making informed decisions when it comes to buying a home. Ramsey discusses the importance of working with a qualified real estate professional and ensuring that your home purchase fits within your budget and long-term financial goals.

Chapter 13: “The Three-Story House” Ramsey explores the idea of paying off the mortgage and owning your home outright. He emphasizes the financial freedom and peace that comes with living in a mortgage-free home. The author encourages readers to prioritize their mortgage payoff in the later Baby Steps of his plan.

Chapter 14: Retirement Reality Check The author provides a reality check on retirement savings. Ramsey emphasizes the importance of saving consistently for retirement and addresses the potential pitfalls and challenges individuals may face as they plan for their golden years.

Chapter 15: The Downside of Money Ramsey addresses the potential pitfalls and temptations that come with financial success. He discusses the responsibility that comes with wealth and provides insights into how to handle these challenges while maintaining a sense of humility and financial responsibility.

Top 5 Insights from “The Total Money Makeover”

- Debt-Free Living: Ramsey’s central message is the importance of living a debt-free life. He argues that debt, particularly consumer debt, is a major obstacle to financial security.

- Emergency Fund: The book emphasizes the significance of having an emergency fund to cover unexpected expenses and avoid going further into debt during emergencies.

- Baby Steps: Ramsey’s seven Baby Steps provide a clear and structured path to financial freedom, making the process of managing money and building wealth more manageable.

- Budgeting: Ramsey’s envelope system and budgeting approach help readers take control of their finances by assigning every dollar a purpose.

- Long-Term Wealth Building: The book encourages readers to think about long-term financial goals and investing for retirement, reinforcing the idea that financial security is a journey, not a destination.

Real-Life Examples

Numerous individuals and families have read “The Total Money Makeover” and successfully followed Dave Ramsey’s plan and achieved financial freedom. They have paid off substantial amounts of debt, saved for emergencies, and built wealth through disciplined budgeting and wise investing. Ramsey’s radio show and podcast feature many callers who share their inspiring success stories after following the principles outlined in the book.

One real-life example of a person who was inspired by “The Total Money Makeover” is Rachel Cruze. Cruze was $22,000 in debt when she was 23 years old. She used the principles in The Total Money Makeover to get out of debt in just three years. She is now a successful author and speaker who helps others to get out of debt and achieve financial freedom.

Conclusion

“The Total Money Makeover” by Dave Ramsey offers a practical and structured approach to personal finance. It emphasizes the importance of eliminating debt, saving, and investing for the long term. Ramsey’s Baby Steps provides a clear roadmap for readers to follow on their journey to financial peace. The book has been instrumental in helping people take control of their finances, break free from debt, and achieve their financial goals. It serves as a powerful guide for anyone looking to transform their financial life and build a secure future.

Our Verdict of “The Total Money Makeover”

Pros of The Total Money Makeover:

- Simple and straightforward financial advice

- Effective plan for getting out of debt and achieving financial freedom

- Focus on living below your means and saving for the future

- Popular and well-respected author

- Many resources available to support readers, including books, podcasts, and live events

Cons of The Total Money Makeover:

- Some people find Ramsey’s advice to be too strict or unrealistic

- Ramsey’s focus on Christianity may alienate some readers

- Ramsey has been criticized for promoting products and services that benefit his own business

Final Verdict:

The Total Money Makeover is a good book for people who are serious about getting out of debt and achieving financial freedom. Ramsey’s advice is simple, straightforward, and effective. However, some people may find his advice to be too strict or unrealistic, and his focus on Christianity may alienate some readers.

Overall, I recommend The Total Money Makeover to people who are looking for a proven plan to get out of debt and achieve financial freedom. However, I encourage readers to be critical of Ramsey’s advice and to do their own research before making any major financial decisions.

My personal recommendation:

I recommend reading The Total Money Makeover with an open mind. Take what you find useful and leave the rest. Ramsey’s seven baby steps are a great foundation for a solid financial plan. However, you may need to adjust the plan to fit your own individual circumstances and goals.

While The Total Money Makeover is a great book, there are several other books that are as inspiring as The Total Money Makeover. Click here to read the abstract of more such inspiring books.