The Richest Man in Babylon by George S. Clason – A 10-Chapter Treasure of Wealth and Prosperity

Table of Contents

Introduction

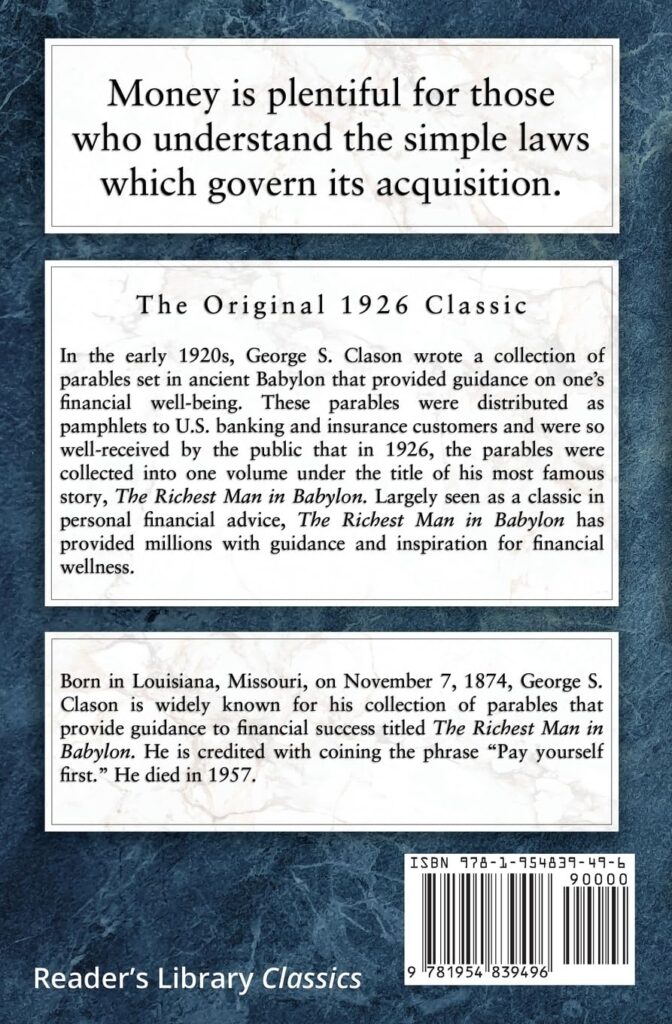

“The Richest Man in Babylon” is a revered classic in the realm of personal finance literature. Written by George S. Clason, this book presents a collection of ancient Babylonian parables and financial principles that offer valuable lessons on wealth-building and financial wisdom. The book’s timeless wisdom has made it a staple in financial education, empowering readers to take control of their financial destinies.

In a series of engaging stories set in ancient Babylon, readers are introduced to Arkad, the titular richest man. Through his conversations and experiences, the book imparts financial knowledge that transcends time. Clason’s writing style is straightforward and accessible, making the book suitable for readers of all backgrounds.

About the Author: George S. Clason

George S. Clason was a respected writer and businessman. In 1926, Clason began writing a series of pamphlets about financial literacy. The pamphlets were set in ancient Babylon and taught timeless principles of money management, such as the importance of saving, investing, and living below your means. The pamphlets were very popular, and Clason eventually compiled them into a book called The Richest Man in Babylon. “The Richest Man in Babylon,” has been celebrated for its enduring wisdom and practical approach to personal finance. Clason’s ability to distill complex financial concepts into relatable stories is a testament to his skill as an educator.

In addition to The Richest Man in Babylon, Clason also wrote several other books about financial literacy, including The Golden Rule of Money, The Money Master, and The Magic of Wealth.

Chapter-wise Summary of “The Richest Man in Babylon”

Chapter 1: The Man Who Desired Gold: The first chapter of The Richest Man in Babylon, titled “The Man Who Desired Gold,” is about a chariot maker named Bansir who is struggling to make ends meet. He is frustrated that he works hard but never seems to have any money left over.

Bansir’s friend Kobbi suggests that he talk to Arkad, their old friend and the richest man in Babylon, to ask for advice. Arkad imparts the first principle of wealth accumulation:

- If you want to be wealthy, you need to pay yourself first. This means setting aside a percentage of your income for savings and investments before you pay any bills or expenses.

- It is important to live below your means. This means spending less money than you earn. This will allow you to save money and invest it for the future.

- Invest your money wisely. There are many different investment options available, so do your research and choose investments that are right for you.

Chapter 2: The Richest Man in Babylon: This is a pivotal chapter in the book “The Richest Man in Babylon”. In this chapter, the book shifts its focus to the life and experiences of Arkad, the wealthiest man in the ancient city of Babylon. Arkad’s story serves as a practical illustration of the financial principles and wisdom that are shared throughout the book. It explains how Arkad transformed from a modest income earner into the richest man in Babylon through a disciplined approach to money management, which included wise investments.

Arkad became the richest man in Babylon by following these principles. These principles are:

- Path to Prosperity: To embark on a path to financial success, start with a modest income. Apply specific financial principles over time to steadily grow your wealth.

- Prioritize Saving: Make saving a fundamental practice in your financial journey. Allocate a minimum of 10% of your income to savings before budgeting for other expenses. This concept, known as “paying yourself first,” lays the groundwork for your financial success.

- Smart Investment Strategies: Instead of simply saving, actively seek out investment opportunities. Carefully evaluate where to invest your funds to ensure they multiply over time. The focus should be on making your money work for you as a critical aspect of your wealth-building strategy.

- Prudent Financial Decision-Making: In your financial journey, prioritize informed decision-making, avoid impulsive spending, and manage your resources responsibly. These principles are crucial to your financial accomplishments.

Chapter 3: Seven Cures for a Lean Purse: In the third chapter of The Richest Man in Babylon, Arkad presents the “Seven Cures” to improve your financial situation. These cures are:

- Start thy purse to fattening. This is the most important cure of all. If you don’t save money, you will never be able to achieve financial freedom. Arkad recommends saving at least 10% of your income each month. However, if you can save more, that is even better.

- Control thy expenditures. This means living below your means and avoiding unnecessary debt. If you spend more money than you earn, you will never be able to save money. Arkad recommends creating a budget and tracking your spending so that you can see where your money is going.

- Make thy gold multiply. This means investing your money wisely so that it can grow over time. There are many different investment options available, so do your research and choose investments that are right for you. Arkad recommends investing in assets that produce income, such as rental properties or dividend-paying stocks.

- Guard thy treasure from loss. This means protecting your assets from theft, fraud, and other financial risks. Arkad recommends getting insurance and taking other steps to safeguard your finances.

- Make of thy dwelling a profitable investment. This means investing in your home so that it can increase in value over time. Arkad recommends buying a home in a good location and maintaining it well.

- Ensure a future income. This means saving for retirement and other future financial needs. Arkad recommends setting aside at least 15% of your income for retirement.

- Increase thy ability to earn. This means investing in yourself and your education so that you can earn more money in the future. Arkad recommends taking classes, reading books, and attending workshops to learn new skills.

By following these seven cures, you can achieve your financial goals and build a secure future for yourself.

Chapter 4: Meet the Goddess of Good Luck: The chapter “Meet the Goddess of Good Luck” of “The Richest Man in Babylon” teaches us that good luck is not something that happens to us by chance. It is something that we create by taking action and taking calculated risks. The chapter also teaches us that we need to be prepared for success. We need to have a plan and we need to be willing to work hard to achieve our goals.

In this chapter, Arkad teaches the men of Babylon about the nature of good luck and how to attract it. Here are the principles discussed in this chapter:

- Procrastination is the enemy of good luck: Arkad emphasizes that good luck favors those who take action and make things happen, rather than those who wait for opportunities to come to them.

- Good luck is not a matter of chance: Arkad argues that good luck is not a matter of pure chance, but rather a result of taking advantage of opportunities and being prepared to act when they arise.

- Honorable skills and trades lead to success: Arkad points out that the wealthy men of Babylon did not achieve their success through gambling or other forms of chance, but rather through hard work and honorable skills and trades.

- Debt is a barrier to wealth: Arkad stresses the importance of avoiding debt and living within one’s means in order to build wealth and attract good luck.

Overall, the chapter teaches that good luck is not a matter of chance, but rather a result of taking action, being prepared, and living a responsible and honorable life.

Chapter 5: The Five Laws of Gold: In chapter 5 of “The Richest Man in Babylon”, Arkad introduces the “Five Laws of Gold,” explaining how to make money work for you through prudent investments, seeking expert financial advice, protecting your investments, and ensuring your financial choices align with your goals. Here is a more detailed explanation of each law:

- The first law: Gold cometh gladly and in increasing quantities to any man who will put by not less than one-tenth of his earnings to create an estate for his future and that of his family. This law teaches the importance of saving money. Arkad recommends saving at least 10% of your income each month. This will help you to build wealth over time.

- The second law: Gold laboreth diligently and contentedly for the wise man, who invests it advantageously and under the counsel of men experienced in such matters. This law teaches the importance of investing your money wisely. Arkad recommends investing in assets that produce income, such as rental properties or dividend-paying stocks.

- The third law: Gold multiplicth itself in the hands of its first owner who finds for it a profitable investment. This law teaches that money can grow over time if it is invested wisely. Arkad recommends investing in assets that have the potential to appreciate in value.

- The fourth law: Gold slippeth away from the man who invests it unadvisedly or who follows the alluring advice of tricksters and schemers. This law warns against investing your money in risky or fraudulent schemes. Arkad recommends doing your research and investing in assets that you understand.

- The fifth law: Gold doth not remain with the wasteful man who spends it foolishly. This law teaches the importance of living below your means. Arkad recommends spending less money than you earn and avoiding unnecessary debt.

Chapter 6: The Gold Lender of Babylon: In chapter 6 of “The Richest Man in Babylon”, readers are introduced to Mathon, a prominent gold lender in the city of Babylon. Mathon plays a pivotal role in imparting financial wisdom to the people of Babylon. Here are the key principles discussed in this chapter:

- Protection of Investments: Mathon underscores the importance of safeguarding one’s investments. He advises borrowers to provide adequate security for their loans, ensuring that their pledged collateral matches the value of the loan. This principle emphasizes the significance of protecting one’s financial interests.

- Seeking Expert Financial Advice: Mathon is portrayed as a knowledgeable financial expert, and individuals in Babylon often consult him before making significant financial decisions. This highlights the value of seeking guidance from experienced professionals when managing one’s finances.

- Responsible Borrowing: The chapter also addresses the responsibility of borrowers. Mathon encourages borrowers to borrow wisely and ensure they have a sound plan for repaying their debts. This principle promotes responsible borrowing and avoiding excessive debt.

Chapter 7: The Walls of Babylon: Chapter 7 of “The Richest Man in Babylon” primarily focuses on the defense of Babylon and indirectly imparts principles that can be adapted for finance as well. There are valuable lessons that can be derived from this chapter:

- Protection of Assets: The chapter underscores the importance of protecting one’s assets, whether they are financial, personal, or related to one’s home and community. This principle encourages individuals to take measures to safeguard their wealth and well-being.

- Community and Unity: The defenders of Babylon, including the elderly character Banzar, exemplify the strength of a united community. This chapter highlights the power of coming together in times of crisis and the importance of supporting one another.

- Resilience: Despite facing adversity and challenges, the people of Babylon show remarkable resilience and determination. This resilience can be applied to financial situations, emphasizing the importance of perseverance in the face of financial setbacks.

- Long-Term Thinking: While the immediate focus in the chapter is on the city’s defense, the overarching theme of protecting Babylon emphasizes the value of long-term thinking. This can be translated to financial planning, where individuals should consider the long-term security and protection of their wealth.

Chapter 8: The Camel Trader of Babylon: Chapter 8 of “The Richest Man in Babylon” introduces the character of Dabasir, a camel trader, and offers broader life lessons related to personal growth, resilience, learning from mistakes, and ethical decision-making, which can be applied to various aspects of one’s life, including financial planning. The valuable principles from the chapter are:

- The Consequences of Poor Choices: Dabasir’s early involvement with a gang of robbers and his subsequent capture serve as a stark reminder of the potential consequences of poor choices and illegal activities. This underscores the importance of making ethical and responsible decisions in life, including in financial matters.

- Resilience and Redemption: Dabasir’s journey from a life of crime to one of potential redemption and financial success highlights the human capacity for change and resilience. It demonstrates that even in challenging circumstances, individuals can find opportunities for transformation and self-improvement.

- Learning from Mistakes: Dabasir’s experiences also emphasize the value of learning from one’s mistakes. His past actions led to hardships, but he uses these experiences to make wiser choices in the future. This principle encourages individuals to reflect on their financial decisions and make improvements based on past errors.

- The Importance of Adaptability: Dabasir’s life takes unexpected turns, and he adapts to his changing circumstances. This underscores the importance of being adaptable and flexible in financial planning, as unforeseen events can impact one’s financial journey.

- Reclaiming Honor by Settling Debts: Dabasir’s act of paying off the debts he had accumulated while working as a saddle maker is a crucial lesson from the chapter. It highlights the significance of honoring financial obligations, both as a matter of personal integrity and as a means to regain financial freedom and honor.

Chapter 9: The Clay Tablets from Babylon: In Chapter 9 of “The Richest Man in Babylon,” titled “The Clay Tablets from Babylon,” a professor sends a set of ancient clay tablets to Mr. Shrewsbury. These tablets contain a formula for getting out of debt and achieving financial success. Mr. Shrewsbury, who is struggling with debt and personal finances, deciphers the message on the tablets.

The key principle in this chapter is the importance of seeking financial knowledge and guidance. Mr. Shrewsbury’s transformation from a state of debt and financial struggle to one of financial empowerment highlights the transformative power of financial education and the application of sound financial principles. This chapter reinforces the idea that anyone can improve their financial situation by acquiring knowledge and taking practical steps to manage their finances effectively.

It also underscores the importance of debt management and provides a formula for those burdened by debt to regain control of their financial lives. The chapter serves as a reminder that financial knowledge and wise financial decisions can lead to a brighter financial future.

Chapter 10: The Luckiest Man in Babylon: In this chapter of “The Richest Man in Babylon”, Sharru Nada reflects on his transformation from a state of debt, slavery, and his struggle to become the “luckiest man in Babylon.” The core principles highlighted in this chapter include:

- Continuous Learning: Sharru Nada stresses the importance of lifelong learning and personal development. His commitment to acquiring new knowledge has been instrumental in his financial success.

- Avoiding Impulsive Spending: Sharru Nada shares his ability to control impulsive spending habits, allowing him to allocate a significant portion of his income to savings and investments.

- Taking Personal Responsibility: The chapter underscores the significance of personal responsibility for one’s financial future. Sharru Nada’s story illustrates that individuals must take ownership of their financial well-being and make wise decisions.

- Hard Work and Diligence: Sharru Nada’s journey serves as a testament to the value of hard work and diligence. His dedication and effort have been key to his financial success, emphasizing that there are no shortcuts to prosperity.

- Avoiding the Easy Way Out: Sharru Nada’s story encourages readers to resist the temptation of taking the easy way out in financial matters. Instead, he demonstrates that real financial success is achieved through disciplined effort.

This chapter underscores the transformative power of continuous learning, saving, personal commitment, hard work, and dedication to financial growth.

Top 5 Insights from “The Richest Man in Babylon”:

- Pay Yourself First: The book’s core principle is saving a portion of your income before all other expenses. This practice sets the foundation for wealth accumulation.

- Debt Avoidance: “The Richest Man in Babylon” emphasizes steering clear of debt and living within your means to avoid financial pitfalls.

- Smart Investment: The “Five Laws of Gold” stress the importance of making informed investments in assets that appreciate over time.

- Seeking Expertise: Throughout the book, the value of seeking financial advice from knowledgeable sources is highlighted.

- Personal Responsibility: The book champions individual accountability for financial outcomes, rejecting the notion that wealth hinges solely on luck.

Real-Life Examples: Numerous individuals and families have been inspired by “The Richest Man in Babylon” to take charge of their finances. For instance, John and Jane Smith, a hypothetical couple, adopted the book’s principles, successfully paid off their debts, cultivated consistent saving habits, and embarked on informed investments, ultimately achieving financial stability.

Practical Applications of the Principles from “The Richest Man in Babylon”

The Richest Man in Babylon is a book that contains timeless principles of money management. Here are some practical applications from the book:

- Set up a direct deposit from your paycheck to your savings account: This way, you will automatically save money each month without even having to think about it.

- Create a budget and track your spending: This will help you to identify areas where you can cut back on expenses.

- Invest: There are plenty of good ways to invest your money. Stock market, Real Estate, Art, Mutual Funds, Precious Metals, etc. Learn about investing in these instruments and invest wisely.

- Get disability insurance and life insurance. This will protect your family in case you are unable to work or if you die unexpectedly.

- Volunteer your time to a cause that you care about. This is a great way to give back to your community and make a difference in the world.

Conclusion

“The Richest Man in Babylon” continues to be a timeless and invaluable resource for those seeking financial success and stability. Its enduring lessons on saving, investing, and responsible financial management are as relevant today as they were when the book was written. This book offers a sturdy foundation for readers to seize control of their financial destinies and embark on a path to lasting prosperity.

Our Verdict about “The Richest Man in Babylon”

Pros: “The Richest Man in Babylon” offers enduring financial wisdom in an accessible format. Its principles are actionable and provide a clear roadmap to financial success.

Cons: Some readers may find the language and parable-style storytelling slightly dated, and the book primarily focuses on fundamental financial principles.

Final Verdict: “The Richest Man in Babylon” is a must-read for individuals seeking a solid financial education. Its principles tried and true, empower readers to take control of their financial destinies and embark on a path to lasting prosperity.

While The Richest Man in Babylon is a great book, there are several other books that are as inspiring as The Richest Man in Babylon. Click here to read the abstract of more such inspiring books.

For bookworms seeking to enhance their financial knowledge, delving into public domain works accessible through free online libraries is a delightful endeavor. Among the vast collection, you’re bound to uncover timeless gems that impart valuable wisdom on personal finance. Here are a few excellent platforms where you can unearth public-domain treasures: