Charlie Munger: A Life of Learning, Investing, and Practical Wisdom | 10 Lessons from Munger’s Life

Table of Contents

Introduction

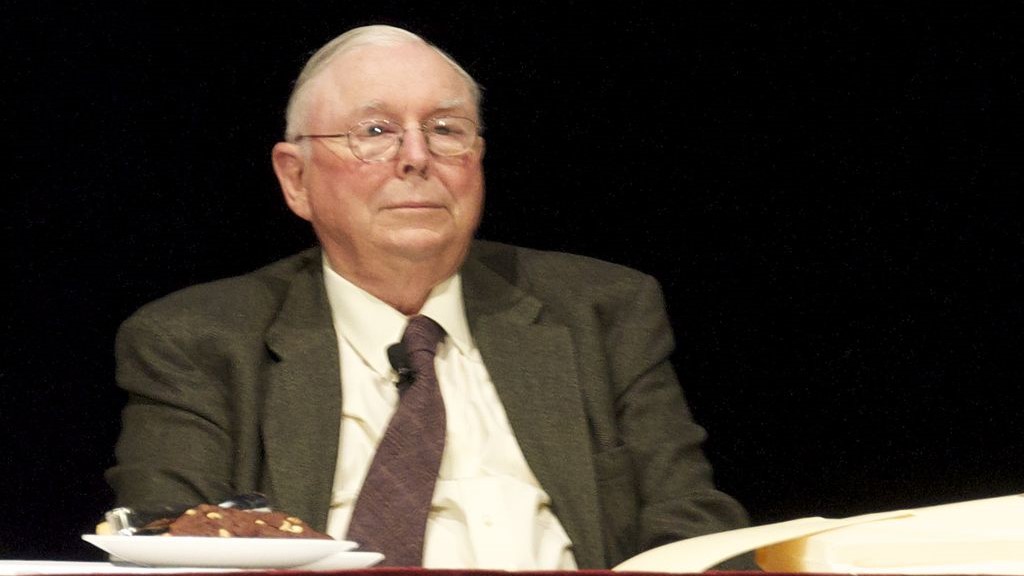

Today, we find ourselves in a somber moment as we bid farewell to an icon of the financial world, Charlie Munger. His passing marks the end of an era, leaving us to reflect on the extraordinary journey of a man whose influence extended far beyond the boardroom. Born on January 1, 1924, in Omaha, Nebraska, Munger’s life was a testament to intellectual curiosity and an unyielding commitment to understanding the intricacies of the financial realm.

Nick, CC BY 2.0 https://creativecommons.org/licenses/by/2.0, via Wikimedia Commons

Munger’s name became synonymous with Berkshire Hathaway, the conglomerate he helped shape alongside Warren Buffett. Their partnership wasn’t just about wealth creation; it was a fusion of two brilliant minds, transforming Berkshire Hathaway into a powerhouse of investments.

His story is one of diverse education, from studying mathematics at the University of Michigan to delving into the intricacies of law at Harvard. These varied pursuits laid the foundation for Munger’s unique approach to problem-solving in the finance world.

As we say our goodbyes, we remember not just the wealth he accumulated but the lasting impact of his wisdom—a guiding light for investors and thinkers alike, navigating the complex tapestry of life and finance.

Charlie Munger’s Education and Personal Life

Charlie Munger (Charles Munger), born on January 1, 1924, in the heartland of Omaha, Nebraska, embarked on a remarkable journey that would shape the landscape of finance. Growing up during the tumultuous years between the two World Wars, Munger’s early life was marked by a tenacious spirit and a thirst for knowledge.

His educational path took a diverse trajectory, reflecting the breadth of his intellectual curiosity. Munger’s pursuit of understanding started at the University of Michigan, where he delved into the world of mathematics. This early academic venture laid the groundwork for a mind that would later dissect and navigate the complexities of investments with precision.

Not content to confine himself to one field, Munger’s educational journey took another turn, leading him to Harvard Law School. Here, he honed his analytical skills, marrying the logical rigor of mathematics with the intricacies of legal thought. This interdisciplinary approach would become a hallmark of Munger’s later success in the world of finance.

As he moved through the corridors of academia, little did young Charlie Munger know that his diverse education would become the bedrock of a partnership with Warren Buffett and a legacy that would transcend the conventional boundaries of Wall Street. The early chapters of Munger’s life and education laid the foundation for the financial sage he would later become, leaving an indelible mark on the history of investing.

Munger’s personal life was intertwined with two marriages, each bringing unique experiences and shaping his family dynamics.

His first marriage to Nancy Huggins in 1945 resulted in three children: Teddy Munger, Molly Munger, and Wendy Munger. While the marriage ended in divorce in 1953, the couple remained amicable, and Munger cherished the bond with his children.

In 1956, Munger found love again with Nancy Barry, and their union spanned over five decades until Nancy’s passing in 2010. Together, they had four children: Charles T. Munger Jr., Emilie Munger Ogden, Barry A. Munger, and Philip R. Munger. This marriage was a source of great joy and companionship for Munger, and the couple shared a deep respect and admiration for each other. Munger didn’t marry after Nancy Barry’s passing.

What inspired Charlie Munger

Charlie Munger was inspired by a multitude of sources throughout his life. His intellectual curiosity and insatiable thirst for knowledge led him to draw inspiration from a wide range of disciplines, including philosophy, history, psychology, economics, and business.

Philosophy

Munger was deeply influenced by the works of philosophers such as Aristotle, Seneca, and Benjamin Franklin. He admired their wisdom, logic, and ability to distill complex ideas into practical principles. He incorporated these philosophical insights into his own thinking, helping him to make informed decisions and navigate the complexities of the world.

History

Munger found inspiration in the study of history, particularly the lives of great leaders, thinkers, and entrepreneurs. He analyzed their strategies, decisions, and failures to gain insights into human nature and the dynamics of success. He also drew parallels between historical events and contemporary business practices, helping him to understand the cyclical nature of the market and the importance of adaptability.

Psychology

Munger was fascinated by the field of psychology, recognizing its profound impact on human behavior and decision-making. He studied the work of psychologists such as Daniel Kahneman and Amos Tversky, gaining insights into biases, heuristics, and the limits of human rationality. He used these psychological principles to make better investment decisions and navigate interpersonal relationships effectively.

Economics

Munger was a keen student of economics, particularly the theories of value investing developed by Benjamin Graham. He studied the work of economists such as Adam Smith, John Maynard Keynes, and Milton Friedman, gaining insights into market dynamics, economic cycles, and the efficient allocation of capital. He applied these economic principles to his investment philosophy, helping him to identify undervalued companies and generate superior returns.

Business

Munger was an avid reader of business biographies and case studies, studying the strategies and tactics of successful entrepreneurs and business leaders. He analyzed the decisions made by Warren Buffett, Bill Gates, and other iconic figures, seeking to learn from their successes and failures. He incorporated these business lessons into his own approach to investing and management, helping him to build long-lasting businesses and create enduring value.

Munger’s ability to draw inspiration from diverse sources and synthesize knowledge from various disciplines was a cornerstone of his success. His intellectual breadth and open-mindedness allowed him to develop a unique perspective on investing, business, and life. His legacy continues to inspire generations of investors, entrepreneurs, and thinkers to embrace lifelong learning, critical thinking, and the pursuit of wisdom.

Charlie Munger’s Entrepreneurial Journey

Charlie Munger’s entrepreneurial odyssey unfolded as a chronicle of strategic decisions, partnerships, and a keen eye for enduring opportunities. Spanning decades, his journey traces a path through key milestones that shaped both his career and the landscape of business.

FrankTursetta, CC BY-SA 4.0 https://creativecommons.org/licenses/by-sa/4.0, via Wikimedia Commons

- Early Legal Career (1940s-1950s): Munger began his professional journey as a lawyer, establishing himself with a successful legal practice. This early chapter not only showcased his legal prowess but also laid the groundwork for the entrepreneurial ventures that would follow.

- Formation of Munger, Tolles & Olson (1962): In the early 1960s, Munger co-founded the law firm Munger, Tolles & Olson. This venture not only solidified his reputation as a skilled attorney but also provided a platform to understand the intricacies of business transactions.

- Partnership with Warren Buffett (1973): A transformative moment came when Munger merged his law practice with Warren Buffett’s investment firm in 1973. This partnership laid the foundation for their collaborative entrepreneurial efforts, marking the birth of a long and fruitful association.

- Investing in Wesco Financial Corporation (1974): Munger’s entrepreneurial vision extended to the shaping of Wesco Financial Corporation. Under his leadership, Wesco became an integral part of the Berkshire Hathaway empire.

- Berkshire Hathaway’s Transformation (1970s-1980s): Munger played a pivotal role in reshaping Berkshire Hathaway into a global conglomerate. The company’s shift from a textile manufacturing focus to a diverse portfolio of investments reflected Munger’s strategic influence.

- Investments in Blue-Chip Companies (1980s-1990s): Munger’s entrepreneurial acumen shone through as he guided Berkshire Hathaway to invest in blue-chip companies like Coca-Cola in the 1980s, demonstrating a foresight that transcended short-term gains.

- Diversification and Expansion (2000s-2010s): The 21st century witnessed further diversification and expansion of Berkshire Hathaway’s portfolio under Munger’s guidance. Investments in sectors ranging from technology to energy underscored his adaptability and forward-thinking approach.

- Enduring Legacy (1924-2023): Charlie Munger’s entrepreneurial legacy extends beyond his time with us. His enduring influence on Berkshire Hathaway and the principles he instilled will continue to shape the company’s trajectory. As we reflect on the milestones of his remarkable journey, we recognize that even in his absence, Munger’s wisdom, teachings, and the indelible mark he left on the world of finance will resonate for generations to come.

Charlie Munger’s Philanthropy

Charlie Munger was a dedicated philanthropist, generously supporting various causes throughout his life. He believed in using his wealth to make a positive impact on society and was particularly passionate about education.

Education

Munger’s most significant philanthropic contributions were directed towards education. He recognized the transformative power of education and its ability to empower individuals and societies. He made substantial donations to his alma mater, Harvard Law School, and the University of Michigan, supporting scholarships, professorships, and building projects.

At Harvard Law School, Munger established the Munger Center for Law and Economics, a renowned research center dedicated to advancing the understanding of the intersection of law, economics, and other social sciences. He also founded the Munger Professorship of Mathematics at the California Institute of Technology, fostering excellence in mathematical research and education.

Munger’s support for education extended beyond his alma mater. He donated to numerous universities and educational institutions, including the University of California, Santa Barbara, where he funded the construction of student housing facilities. He also supported the development of educational programs and initiatives that aimed to improve access to quality education for underprivileged students.

Other Causes

Munger’s philanthropic reach extended beyond education to encompass a wide range of causes. He was a strong advocate for medical research and supported various medical institutions and research foundations. He believed in the power of scientific innovation to improve human health and alleviate suffering.

Munger also supported organizations dedicated to poverty alleviation, recognizing the importance of economic empowerment and social justice. He contributed to initiatives that aimed to provide access to education, healthcare, and employment opportunities for those in need.

In addition, Munger was a passionate animal welfare advocate. He supported organizations that worked to protect animals from cruelty and improve their lives. He believed in the intrinsic value of animals and the importance of treating them with compassion.

Philanthropic Philosophy

Munger’s philanthropic approach was characterized by his long-term vision and commitment to sustainable impact. He believed in investing in causes that could create lasting positive change and empower individuals and communities. He also emphasized the importance of careful evaluation and strategic planning to ensure that his donations were used effectively.

Munger’s generosity and dedication to philanthropy left a lasting legacy. His contributions to education, medical research, poverty alleviation, and animal welfare have made a profound impact on the lives of countless individuals and communities. His example continues to inspire others to give back and make a positive difference in the world.

Charlie Munger’s Luxurious Possessions

Despite being one of the most successful investors in history, Charlie Munger was known for his modest lifestyle and aversion to material possessions. He valued simplicity and practicality over extravagance, and his personal belongings reflected this philosophy.

Unlike many wealthy individuals who accumulated lavish homes, cars, and other luxuries, Munger lived in a relatively unassuming home in Pasadena, California. His residence was reportedly filled with books, newspapers, and other intellectual pursuits rather than ostentatious displays of wealth.

In terms of transportation, Munger preferred to drive a modest car, often opting for a used Toyota or Volvo. He saw cars as a means of transportation rather than a status symbol, and he valued reliability and practicality over luxury.

Munger’s approach to personal possessions extended to his clothing as well. He favored simple, comfortable clothing that reflected his practical and unpretentious nature. He was often seen in collared shirts, khakis, and sweaters, prioritizing comfort and functionality over fashion trends.

Overall, Charlie Munger’s lifestyle choices stood in contrast to the stereotypical image of a wealthy individual. He prioritized intellectual pursuits, practicality, and simplicity over material possessions, demonstrating that true wealth lies not in accumulating possessions but in cultivating a meaningful and fulfilling life.

Interesting Facts about Charlie Munger

https://commons.wikimedia.org/wiki/File:Sandro_Salsano_and_Charlie_Munger.jpg

Cnbc2017, CC BY-SA 4.0 https://creativecommons.org/licenses/by-sa/4.0, via Wikimedia Commons

Charlie Munger, the brilliant mind behind Berkshire Hathaway and renowned for his wit and wisdom, has several interesting facets to his life. Here are some intriguing facts about Charlie Munger:

- Diverse Education: Munger’s educational journey is quite eclectic. He studied mathematics at the University of Michigan and later attended Harvard Law School. This interdisciplinary background contributed to his unique approach to problem-solving in the world of finance.

- Long-Term Partnership: Munger’s partnership with Warren Buffett spans several decades. The two first met in 1959, and Munger officially joined Berkshire Hathaway as Vice Chairman in 1978. Their enduring collaboration has been a key factor in the company’s success.

- Minimalist Lifestyle: Despite his considerable wealth, Munger is known for his frugal lifestyle. He continued to live in the same house he bought in the 1950s and reportedly drove a modest car. His focus on simplicity and minimalism contrasts with the lavish lifestyles often associated with successful investors.

- Witty “Mungerisms”: Munger is famous for his succinct and insightful “Mungerisms” or quotes. Phrases like “invert, always invert” and “take a simple idea and take it seriously” encapsulate his unique perspective on decision-making and problem-solving.

- Law and Investment: Before his extensive career in investments, Munger had a successful legal career. He co-founded the law firm Munger, Tolles & Olson in the 1960s. His legal background provided a solid foundation for understanding business transactions.

- Wesco Financial Corporation: Munger served as the chairman of Wesco Financial Corporation for many years. The company, under his leadership, became a subsidiary of Berkshire Hathaway and was involved in various financial services.

- Philanthropy: While Munger kept aspects of his personal life private, he was known for his philanthropic efforts. He made significant contributions to educational and medical research institutions, reflecting his commitment to giving back.

- Lecturer at Harvard-Westlake School: Munger has served as a trustee and lecturer at the Harvard-Westlake School in Los Angeles. His involvement in education extended beyond his financial ventures.

- Book Author: Munger’s wisdom and insights are compiled in the book “Poor Charlie’s Almanack: The Wit and Wisdom of Charles T. Munger,” a collection of his speeches and thoughts on life and business.

- Life Beyond Finance: Munger’s interests are not confined to finance. He has expressed a keen interest in a wide range of subjects, including psychology, economics, and various academic disciplines, contributing to his well-rounded perspective.

Charlie Munger’s life is a tapestry of diverse experiences, wisdom, and a commitment to lifelong learning, making him a multifaceted figure in both the financial and intellectual spheres.

Inspiring Quotes by Charlie Munger

Charlie Munger is known for his insightful and often witty quotes that reflect his unique approach to investing and life. Here are some inspiring quotes by Charlie Munger:

- “Invert, always invert: Turn a situation or problem upside down. Look at it backward. What happens if all our plans go wrong? Where don’t we want to go, and how do you get there? Instead of looking for success, make a list of how to fail instead — through sloth, envy, resentment, self-pity, entitlement, all the mental habits of self-defeat. Avoid these qualities and you will succeed.”

- “The best thing a human being can do is to help another human being know more.”

- “It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.”

- “The big money is not in the buying and selling, but in the waiting.”

- “Spend each day trying to be a little wiser than you were when you woke up.”

- “The desire to get rich fast is pretty dangerous.”

- “I think I’ve been in the top 5% of my age cohort all my life in understanding the power of incentives, and all my life I’ve underestimated it. And never a year passes but I get some surprise that pushes my limit a little farther.”

- “The iron rule of nature is you get what you reward for. If you want ants to come, you put sugar on the floor.”

- “You are not going to get very far in life based on what you already know. You’re going to advance in life by what you’re going to learn after you leave here.”

- “The game of life is the game of everlasting learning. At least it is if you want to win.”

These quotes encapsulate Munger’s philosophy on investing, learning, and decision-making, offering valuable insights for those seeking success in various aspects of life.

10 Lessons from Charlie Munger’s Life

Charlie Munger’s life is a treasure trove of lessons, not just in investing but in the broader context of decision-making, learning, and personal development. Here are 10 valuable lessons from Charlie Munger’s life:

- Diversify Your Knowledge: Munger’s interdisciplinary approach to learning — blending various fields like mathematics, psychology, and economics — emphasizes the importance of a well-rounded education. Diversify your knowledge to enhance your problem-solving abilities.

- Long-Term Thinking: Munger’s investment philosophy is rooted in the concept of long-term thinking. He advises against the desire for quick riches and encourages patience and a focus on enduring value.

- Embrace Mistakes as Learning Opportunities: Munger advocates for learning from mistakes. Instead of dwelling on errors, use them as opportunities for growth and improvement. The ability to adapt and evolve comes from a willingness to acknowledge and learn from failures.

- Invert Your Thinking: The idea of inversion, a common Munger principle, involves approaching problems by considering the opposite. By analyzing what not to do, you often gain clarity on the best course of action.

- The Power of Incentives: Munger’s understanding of human behavior is heavily influenced by the power of incentives. Recognize how incentives drive decisions and outcomes, both in yourself and in others.

- Frugality and Simplicity: Munger’s minimalist lifestyle, despite considerable wealth, teaches us that true wealth is not about extravagant possessions but about simplicity and a focus on what truly matters.

- Continuous Learning: Munger’s commitment to lifelong learning is evident in his advice to “spend each day trying to be a little wiser.” Embrace a mindset of continuous learning to adapt to an ever-changing world.

- Avoid Envy and Resentment: Munger warns against succumbing to negative emotions like envy and resentment. These emotions not only hinder personal growth but can cloud judgment and impede rational decision-making.

- Seek Quality in Investments and Relationships: Munger emphasizes the importance of seeking quality — whether in businesses or personal relationships. Surround yourself with people and opportunities that possess enduring value.

- Humility and Intellectual Humility: Munger’s humility is a hallmark of his character. He readily acknowledges mistakes and seeks continuous improvement. Intellectual humility, the willingness to admit when you don’t know something, is a key aspect of his success.

Incorporating these lessons from Charlie Munger’s life into your own journey can contribute to personal and professional growth, fostering a mindset that transcends the world of finance and extends to the broader spectrum of life’s challenges and opportunities.

Conclusion

Charlie Munger’s life is a testament to wisdom and principled living, weaving through finance, intellect, and profound lessons. From his beginnings in Nebraska to his diverse journey in law, investments, and philanthropy, Munger’s story reflects resilience, constant learning, and a dedication to enduring values.

His impact in finance, notably at Berkshire Hathaway, goes beyond numbers, leaving a legacy of inspiration. Munger’s approach to learning from various fields, advocating long-term thinking, and staying intellectually humble serves as a guiding beacon in our dynamic world.

In a society often dazzled by extravagance, Munger’s modest lifestyle reminds us that true wealth lies in the simplicity of intellectual and emotional richness. His clever “Mungerisms” transcend finance, offering insights into decision-making and a meaningful life.

As we ponder Munger’s life, his lasting legacy encourages us to flip our thinking, embrace mistakes, and prioritize continuous learning. Though his journey has concluded, the resonance of his wisdom persists, inspiring those who, like him, seek not just financial mastery but also a well-lived life.

There are more than 2000 Billionaires on Earth. Read more inspiring stories of a few of these billionaires on Recharge Inspiration. Did you know Jeff Bezos owns the largest private yacht named Koru which cost him approximately $500 Million? Read more about Jeff Bezos here.